The Federal Budget Tax Bill passed through both houses of Parliament last Friday 9th October and the new tax tables are now available on the ATO’s website. This means that the stage 2 personal income tax cuts have been brought forward and backdated to 1 July this year. Employers have until 16th November to implement these changes and the new tax rates take effect once they have been updated in the payroll system. The tax paid by the employee already received from July-October 2020 will not be impacted until the employee does their tax return at the end of the financial year and any over-taxed amounts will then be refunded as part of their return.

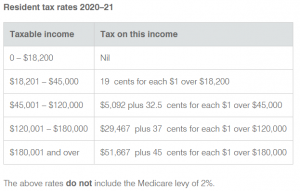

The updated income tax thresholds and rates are as follows:

To access the ATO tax tables and further information about the updated tax rates, click here